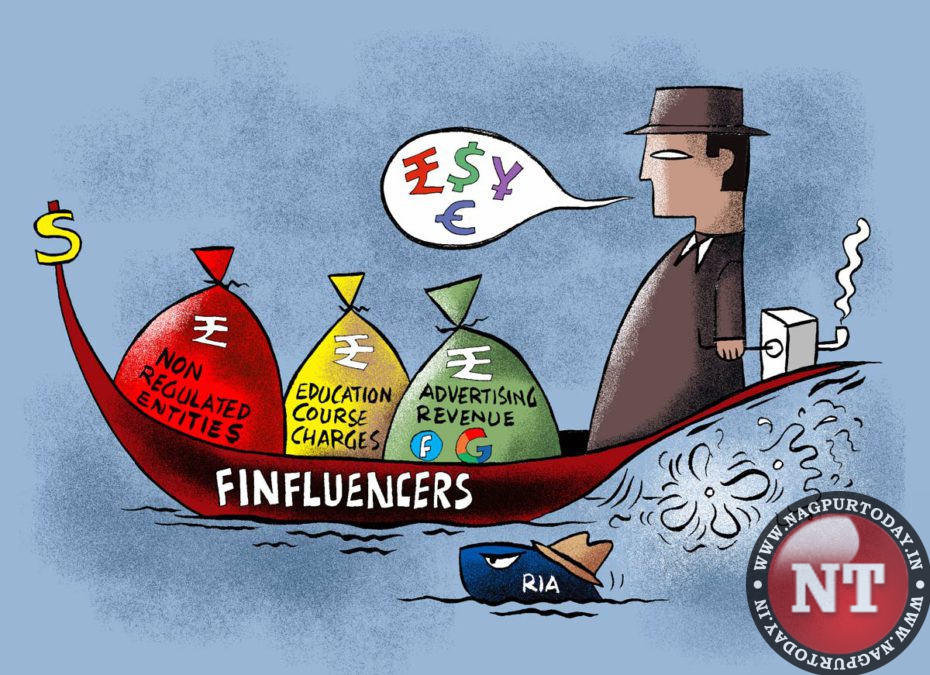

More than 27 per cent of financial influencers or finfluencers do not make adequate disclosures when they are pushing out sponsored content on their platforms, according to research published by the CFA Institute.

Finfluencers captivate their audiences by breaking down complex financial concepts and sharing investment recommendations.

CFA Institute research found that over a quarter could be sponsored content.

Further, nearly a fifth of it is around individual stock recommendations, the research found.

The data assumes significance with regulators globally grappling with moderating and monitoring information by finfluencers.

“Our research shows that finfluencer content often lacks sufficient disclosures, which can hinder the ability of consumers to evaluate the objectivity of the information, and some investors may be unaware when and how finfluencers are being paid to promote financial products,” said Rhodri Preece, senior head of research, CFA Institute, which analysed the content on TikTok, YouTube, and Instagram in key markets such as the United States, United Kingdom, France, Germany, and The Netherlands.

“Some finfluencers may be unaware that their activities are regulated and need appropriate disclosures,” Preece added.

“We urge regulators to consider a universal definition of an investment recommendation, and firms and social media platforms should work with finfluencers to ensure compliance with applicable policies.”