Nagpur: The irregularities in farm loan waiver scheme announced by State Government continue to haunt the farmers on one count or another. A bank bungled and put a beneficiary farmer in the dock.

According to Vice President of MPCC’s Farmers and Farm Labourers’ Cell Sandeep Agrawal, massive bungling in the amounts deposited in banks by State Government on account of farm loan waiver has come to the fore. Agrawal cited a recent instant to stress his point. He said that a Bhedala farmer Sanjay Devrao Lute had taken a laon of Rs 1.50 lakh from Mauda Branch of Bank of Baroda in 2015. But he could not repay the loan. Subsequently, Lute revised the loan and increased by another Rs 1.50 lakh taking to total loan amount to Rs 3 lakh.

According to the eligibility for farm loan waiver, the State Government waived Lute’s loan of Rs 1.50 lakh and sent his name in the list of beneficiaries to Gram Panchayat. This loan was waived in 2017 but surprisingly, Bank of Baroda did not deposit the amount in Lute’s account. Despite Lute’s repeated requests for months, the bank did not correct the wrong. However, when the Bhedala Gram Panchayat received the list of eligible and beneficiary farmers in May 2019, Lute came to know that the Government has waived off his loan of Rs 1.50 lakh. But when Lute went to Mauda Branch of Bank of Baroda, the Branch Manager informed him that an amount of Rs 1.80 lakh is balance against him.

Thinking that after waiving of Rs 1.50 lakh out of Rs 3 lakh, the rest amount could be Rs 1.80 lakh plus interest, Lute immediately deposited the amount in the bank. 2-3 days after, he went to bank for collecting his “No Dues Certificate” but the Branch Manager informed him the loan waiver amount has not been received by the bank and if he wanted the “No Dues Certificate” then he will have to deposit Rs 1.50 lakh, Agrawal said.

Agrawal further said that taken aback by the development, Lute immediately approached the President of District Farmers and Farm Labourers Laxmanrao Mallipaddi and apprised him about the ordeal. Mallipaddi in turn contacted the office of Assistant Registrar of Cooperative Society. The office also informed that Lute’s farm loan has been waived off by State Government. A letter in this regard has been sent to the bank on July 2, 2019. But still the bank was refusing to budge and even denied providing a bank statement, Agrawal lamented.

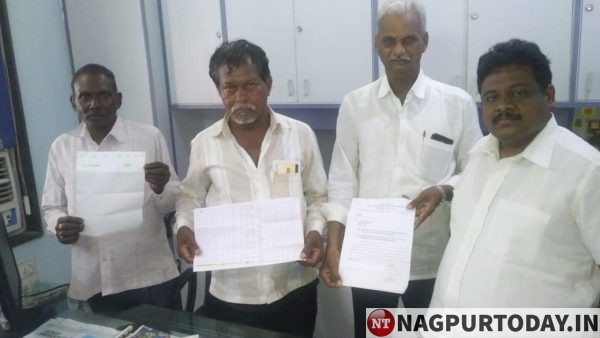

Elaborating further, Agrawal said that all affected farmers came to his office in Nagpur on July 5, 2019, and narrated their problems. He then contacted the Deputy General Manager of Bank Of Baroda Saibabu. Saibabu facilitated a talk with the concerned officials who informed that Lute’s loan of Rs 1.50 lakh was waived off way back in 2017. It means, the concerned bank officials did not deposit the amount in the account of beneficiary deliberately. Now, when the entire sordid episode has come to the fore, the bank has assured to deposit the amount within 2-3 days and the “No Dues Certificate” will be issued forthwith.