- VIA organised discussion on “Post Budget Analysis 2025”

- Black Market Ticket Sales for Ind vs Eng Match: Two Arrested in Nagpur

- Alarming concern: Cancer cases surge in Nagpur, young adults in deadly grip

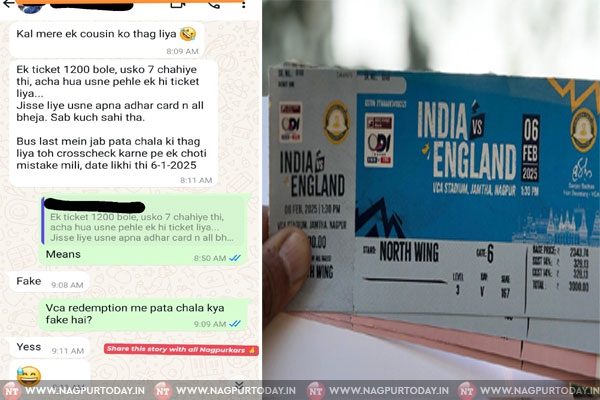

- Caution! Strict Action Against Black Marketing of Tickets on Social Media – Cyber DCP Lohit Matani

- Dawoodi Bohra Community Promotes Interfaith Harmony and Environmental Conservation in Nagpur

- NMC employees caught dumping sewage into Pohra River to face music

- Chase gone wrong: Tiger cub and wild boar fall in same well in MP!!

- Nagpur petroleum trader duped of Rs 1.96 crore

- Land mafia Vijay Ghodke, 2 others granted anticipatory bail in land grabbing case in Nagpur

- Nagpur Traffic Police arrange parking spaces for India-England ODI on Feb 6

- Nagpur Police conduct workshop on Yogic Technique Swadhyaya

- STEPS Karatekas excel at Khasdar Krida Mahotsav

- Police Inspector goes berserk at Mayo Hospital, assaults fellow cops in Nagpur

- Drones to keep an eye on traffic as Nagpur readies for India-England ODI

- Audit shock: CAG slams Maha Govt: Healthcare in shambles, Rs 688 crore go unspent

National News

Top Picks News

Happening Nagpur

Rare Baithak Performance Celebrates Classical Dance in Nagpur

Nagpur: In a city where intimate classical dance performances are a rarity, an exceptional Baithak performance was organized recently by Pooja Bhattad, a Kathak dancer... More...

Nagpur Crime News

Junior College Proposal Approval Scam: Education Officials Caught Accepting Bribes

Nagpur: In a major breakthrough, the Anti-Corruption Bureau (ACB) Zero... More...

- Gigolo Racket Exposed in Nagpur: Who is the Real Mastermind Behind the Operation?

- Nagpur Rural SP’s Security Guard Attempts Suicide by Gunshot

- Sex racket busted at Bit’z Unisex Parlour in Byramji Town, Nagpur

- Nagpur Psychiatrist Accused of Sexual Harassment: Fourth Case Registered Against Him

- FIR against Bhandara SDPO Ashok Bagul in molestation case quashed

- Nagpur set to get new police station at Bhandewadi, 34th in city

- Nagpur: Youth Brutally Murdered in Dhantoli’s Takiya Basti

- Accused in Pickpocketing at CM Fadnavis’s Rally Released on Bail Due to Lack of Evidence

- Man Found Dead by Suicide in Silver Nest Hotel, Nagpur

Sports News

England Team Arrives in Nagpur for ODI Series; Shami, Pandya, Akshar Also Reach

Nagpur, February 3 – The England cricket team arrived in Nagpur on Monday ahead of their highly anticipated three-match ODI series against India, starting February 6 at the VCA Jamtha... More...

-

In Pics: Team India Sweats it Out in Nagpur Ahead of England Clash

Nagpur – The Indian cricket team kicked off their preparations for the upcoming ODI series against England with an intense practice session at the VCA... -

Indian Cricket Stars Arrive in Nagpur for First ODI Against England

Nagpur: The cricket fever in India is at its peak as Team India gears up for the first ODI against England at the VCA Stadium,...

School And College News

Blessing Ceremony of Grade XII at DPS MIHAN

Blessing ceremony for Grade XII was held on 03rd February 2025 in the beautiful sprawling campus of Delhi Public School MIHAN. Dr. Raakesh Kriplani, renowned psychologist of Nagpur city graced... More...

-

Hat-Trick Heroics! DPS Mihan Clinches Third Consecutive Futsal Title

Nagpur: Three day PVC CUP - An Inter-School Futsal Tournament concluded in DPS MIHAN campus on January 31, 2025. The tournament featured intense matches between... -

DNC clinches title in Inter-Collegiate Udghosh Basketball Tournament

Nagpur: The Nagpur-based Dhanwate National College (DNC) basketball team emerged victorious in the Inter-Collegiate Udghosh Basketball Tournament organized by the Department of Physical Education and...