Nagpur: The government’s plan to increase thermal power capacity by 7 gigawatts (GW) has come under scrutiny, as a recent report suggests that acquiring and reviving stranded thermal plants would be a more advantageous option for all stakeholders.

Although the government has asked the country’s largest power producer NTPC to add 7 gigawatts of thermal power capacity, a report found that acquiring and, subsequently, reviving stranded thermal plants is a better option for all stakeholders.

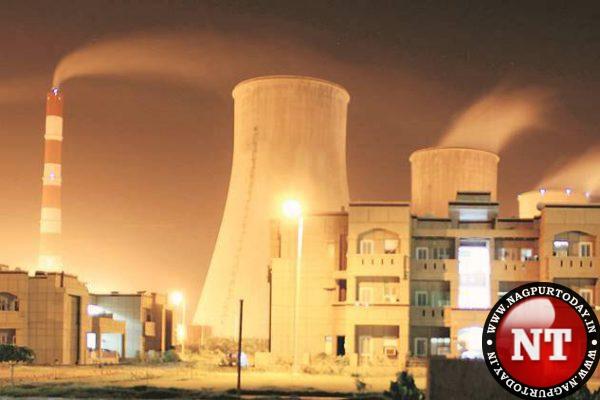

Recently, the Maharashtra Government had decided to replace two old units of the coal-based Koradi Thermal Power Plant with new 660 MW each for which a public hearing has been held. Citizens are opposed to this as they cite an increase in pollution and concern for health.

The Institute for Energy Economics and Financial Analysis (IEEFA) conducted an analysis, which identified several stressed thermal assets with a cumulative capacity of 6.1GW that are suitable for strategic acquisition by NTPC in partnership with other government-owned companies. This report highlights the benefits of such an approach and emphasizes the need to prioritize environmental, social, and governance considerations.

The IEEFA report recommends that NTPC collaborate with Power Finance Corporation-REC and National Asset Reconstruction Company Limited to acquire and revive 6.1GW of stressed thermal assets. By pursuing this path, NTPC can minimize its investment while effectively addressing India’s energy security concerns. Furthermore, the acquisition and subsequent revival of these assets can contribute to cleaning up the books of Indian banks, which have been burdened with high non-performing assets (NPAs) for an extended period.

The report underlines that investing in new thermal power plants entails the potential risk of stranded assets. Acquiring and reviving existing plants mitigates this risk and ensures optimal utilization of available infrastructure.

Citizens’ concerns regarding pollution and health risks associated with coal-based power plants are acknowledged. The acquisition strategy provides an opportunity to retire and repurpose these stressed thermal assets for renewable energy generation, thereby aligning with global Environmental, Social, and Governance (ESG) investor expectations.

Collaborating with government-owned entities such as Power Finance Corporation-REC and National Asset Reconstruction Company Limited allows NTPC to save significantly on upfront investments. Additionally, repurposing the acquired assets for renewable energy generation opens up opportunities in the burgeoning market for carbon credits trading, further improving project returns.

Acquiring and reviving stranded thermal plants can address India’s immediate energy security needs without relying solely on new capacity additions. By leveraging existing infrastructure, NTPC can contribute to the nation’s energy goals more efficiently.

The IEEFA report strongly advocates for the strategic acquisition and subsequent revival of stressed thermal assets as a viable alternative to adding new thermal power capacity. It emphasizes the potential benefits for all stakeholders, including NTPC, government-owned entities, Indian banks, and the environment.

Furthermore, aligning with global ESG investor expectations by retiring and repurposing acquired assets for renewable energy generation enhances NTPC’s sustainability profile. By adopting this approach, India can make significant progress towards its energy security goals while minimizing financial and climate risks associated with new thermal power investments.