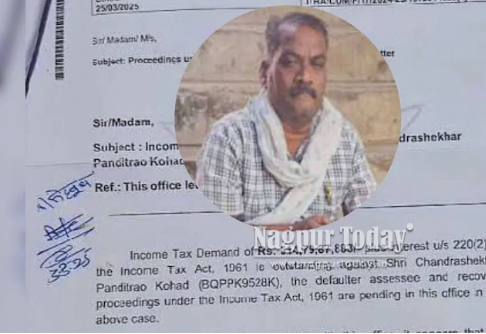

Nagpur – A daily-wage labourer in Nagpur has reportedly received an astonishing income tax notice of ₹314 crore, sparking widespread shock and disbelief. Chandra Shekhar Kohad, originally from Betul district in Madhya Pradesh and currently working as a labourer in Nagpur, has been served the notice by the Income Tax Department.

Kohad lives in extremely poor conditions and reportedly fell ill after receiving the notice. He is currently undergoing treatment at a hospital in Nagpur.

According to the Income Tax Department, Kohad allegedly carried out transactions worth several thousand crores during the financial year 2013-14, with the outstanding tax dues amounting to ₹314 crore. However, Kohad is known to be a hand-to-mouth labourer, making such massive financial dealings highly suspicious.

Authorities suspect this could be a case of major financial fraud or identity misuse. Kohad has demanded a thorough investigation into the matter. The case has raised serious concerns among the public, highlighting the need for swift administrative action.

Income Tax Department Begins Investigation in Nagpur

The Income Tax Department in Nagpur has contacted the Multai Municipal Council in Betul district to gather details about Kohad’s assets. Officials confirmed that Kohad does not own any registered land and that the property in question belongs to one Manohar Harkachand, son of Radhelal Kirad from Amalakha’s Devthan area. This information has been formally communicated to the tax department.

Chandra Shekhar Kohad’s Reaction

Speaking to the media, Kohad said that his wife is seriously ill, and the sudden notice has caused severe mental distress to his entire family. He himself is a heart patient and has suffered a health setback following the notice.

On the other hand, the Income Tax Department claims to have concrete evidence of the massive transactions under Kohad’s name. They also assert that Kohad admitted to several details during initial questioning, indicating that the case may take an unexpected twist as the investigation unfolds.