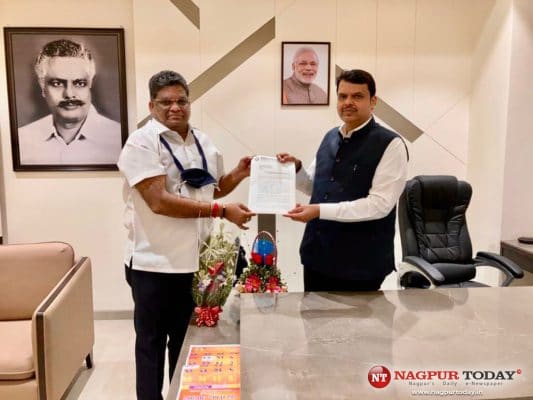

Dr. Dipen Agrawal, President – Chamber of Associations of Maharashtra Industry & Trade (CAMIT) called upon Dy. Chief Minister of State, Devendra Fadnavis to submit a memorandum seeking his intervention in the matter of 5% GST being made applicable on pre-packed and labelled food grains like pulses, flour, cereals and other edible items.

Dr. Dipen Agrawal, informed Devendra Fadnavis that upon conjoint reading of the provisions of Legal Metrology Act (LM Act) and Rules it can be understood that if goods are placed in package in absence of purchaser and in pre-determined quantity (as stipulated under Rule 5 r/w Schedule II) then only the goodsshall fall under the definition of pre-packed commodities and attract the requirement of declaration u/s 18 of the Act. The FAQ issued by administration is silent on this inconsistency between Rule 3 and Rule 26 of the Legal Metrology (Packaged Commodities) Rules, 2011.

Dr. Agrawal explained to Dy. CM, thatthe objectives of the LM Act is to protect the interest of consumers. The LM Act stipulates that every pre-packaged commodity has to be manufactured, packed, imported or sold in such standard quantities or numbers as may be prescribed, if the consumer is not present while goods are placed in the package. The LM Act exempts from its ambit the packing of goods by the seller in presence of the consumer, presumably because the consumer is deemed to have taken care of the quality and quantity of the goods packed in his presence. However, under GST in addition to seller and purchaser the revenue department is also a stake holder. Hence, the satisfaction of revenue officer that goods were packed in presence of purchaser and not in his absence shall give birth to endless litigation.

The then Finance Minister, Late Shri Arun Jaitley ji in press briefing, after first day of 14th GST Council meeting in Srinagar, said that out of 1211 items 50% (fifty percent) of items in the retail inflation basket won’t be taxed in order to protect consumers from price rises on basics such as food grains.Dr. Agrawal, brought in Dy. CM’s attention that since independence no government has ever earned revenue by taxing the subsistence consumption of its citizens. The tax on such consumption is against the ethos of welfare state.

Dr. Agrawal informed that resentment among the farmers, business community and citizens is alike. There is confusion all over. Traders will be burdened with GST compliance. Farmers fear reduction in realisation. Citizens who are already facing the heat of inflation fear further dent in their household budget. Dr. Dipen requested to Devendra Fadnavis, Dy. Chief Minister, Maharashtra to intervene in the matter and to use his good office with union government / GST Council to impress them to revisit and recall the decision to levy 5% GST on pre-packed and labelled food grains instead of levy of GST on branded food grains.

Dy. CM, Devendra Fadnavis after patiently hearing the issues raised assured to take up the matter with central leadership of party and union government for resolution in the best interest of all stakeholders, inform a press release issued by CAMIT.